However, some customers are still at risk of being cut adrift and the banks should do everything they can to ensure the continued provision of essential banking services for years to come.' 'The recent announcement by the banks about how they will protect cash through shared banking hubs, Post Offices and community cashback is welcome. 'These problems are exacerbated when branch closures coincide with poor public transport locally, a lack of ATMs, substandard internet service and mobile black spots, making it increasingly difficult for customers to access their money.

'It's well known that a rapid move towards online banking over the past few years has caused significant problems for many older customers, particularly those with visual impairments and dexterity problems. 'The scale of the bank branch cull over recent years has been extremely damaging for so many local communities nationwide and a serious blow for the millions of older people who rely on them, particularly those who are not online or confident with mobile banking. With thousands of banks now gone from High Streets up and down the UK, groups such as the Post Office have stepped in to provide every-day over-the-counter banking services for people in rural communities.īut campaigners and charities for the elderly say the decision to close village and town centre banks is proving 'extremely damaging' for local communities and a 'serious blow' for millions of older Britons.īanking experts meanwhile have warned that while previous cuts have been to small rural branches, banks are now increasingly shutting sites in medium-sized towns.Īnd there are fears even some large towns of 100,000 people or more may be left without any dedicated branches within a decade.īusiness chiefs have warned also about the perils of the UK moving completely cashless, saying the Russia-Ukraine conflict has exposed the potential pitfalls of relying on online banking.Ĭaroline Abrahams, Age UK Charity Director, said: 'Many older people value the services provided by bank branches, in particular the human touch that a counter service can provide, so it's a concern that more and more local bank branches are not only closing, but also restricting opening hours for customers. Virgin Money, which is axing 30 branches in 2022, said it had no plans to share on bank branches when contacted by MailOnline.įigures show that Britain lost nearly 5,000 High Street banks between 20, with only 8,810 open last year. TSB, which is closing 70 branches in the UK this year, said it is upgrading 220 existing branches and has set up 40 'pop-up' sites.Ī spokesperson for bank said: 'We remain committed to a national branch network, the seventh largest in the UK, but don’t speculate on future plans.' We have been very transparent in communicating decisions about branch closures earlier this year and have no further changes planned, however if this evolves we will go through the correct regulatory process.'

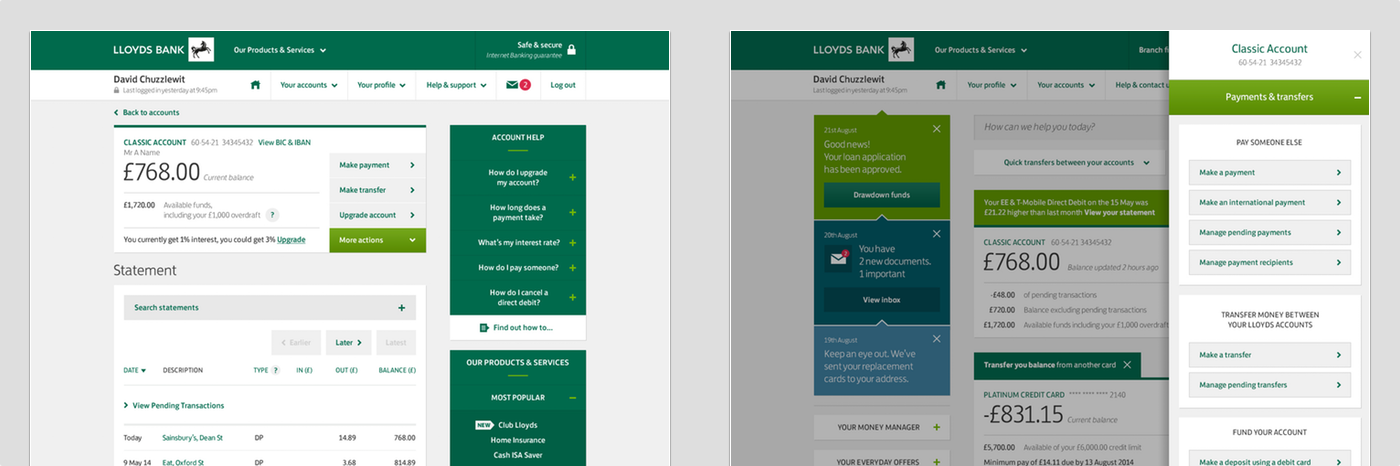

#LLODS TSB INTERNET BANKING FULL#

Meanwhile, Santander will not close any branches, but will reduce opening hours, with some moving to half days.Ī full list of branch closures by all banks and building societies can be found on the website of Link, which is the UK's largest cash machine network.Ī HSBC UK spokesperson said: 'We keep all areas of our business under review, including our Branch Network. TSB has closed 39 and will shut 31 more, while Virgin Money has shuttered 29 and will do so to one more branch.ĭanske Bank is set to close four, Metro Bank will shut three and Ulster Bank will close the doors of nine.

NatWest which includes Royal Bank of Scotland, has closed 31 branches and is scheduled to close another 24 before the end of the year. Lloyds Group, which runs Lloyds Bank, Halifax and Bank of Scotland, has closed 47 branches so far this year, and will close another 88. In March HSBC announced plans to axe 69 branches in the UK, only a year after it closed 82 as part of its 'transformation programme'.Įarlier this week it announced it would slash opening times at 122 branches, with some site reducing hours by 30 per cent.īarclays has already closed 63 branches this year and is set to close another 40 in the next three months. In the longer-term the bank has pledged to keep 625 branches in every town or city where it already has a presence until at least 2024. Nationwide has already close four branches this year and is set to shut three more in the coming months.

0 kommentar(er)

0 kommentar(er)